Rank: Advanced Member

Groups: Registered, Registered Users, Subscribers

Joined: 2/20/2007(UTC)

Posts: 148

Was thanked: 1 time(s) in 1 post(s)

|

In this issue:

Power User Tip: Using Excel with XENITH

Contributed by Breakaway Training Solutions

In this short YouTube video, I'll give you a couple of quick tips on how to get your real-time

data from XENITH into an Excel spreadsheet.

MetaStock - Using Excel with XENITH

For more MetaStock training, make sure to visit Breakaway Training Solutions at www.learnmetastock.com

or email Breakaway Training Solutions at admin@breakawayts.com.

About Kevin Nelson

Kevin Nelson is the founder of Breakaway Training Solutions, Inc. He has spent the

last 17 years becoming an expert on MetaStock software and a serious student of

technical analysis while working for MetaStock. Prior to joining MetaStock in 1993,

Kevin was a stockbroker for a well-known NYSE firm.

In his role as Sales Manager

at MetaStock, Kevin interacted extensively with MetaStock customers via phone, webinars,

and public appearances. His experiences while working at MetaStock have enabled

him to gain a keen understanding of the needs of technical analysts worldwide.

While

with MetaStock, Mr. Nelson was a featured presenter for four years. During this

time, he traveled the U.S. introducing the MetaStock program to thousands of people

and teaching them how to use its many features. His easy-to-understand approach

is considered by many to be the best in the industry.

Back to top

Support Tip: HOW CAN I SEARCH FOR SECURITIES BASED ON FUNDAMENTAL DATA?

MetaStock can only screen securities based on price data and price based indicators.

However,

MetaStock Professional, through the XENITH program can search for and

screen stocks

based on a much more diverse set of criteria. To do this:

- Open XENITH.

- Look at top left and find the blue icon that shows a magnifying glass over a

page (Advanced

Search).

- Click the icon and then select Equites -> Companies

- The Companies Search screen will open.

- In the bottom left, click the Add Criteria button.

- Select the desired fundamental data from the list

- A new line will be added to the search screen and you can enter the requirements

for that data

value.

- Add as many other criteria as desired and then click Search.

Back to top

Slauson's Slant: The Starving Artist

Contributed by John Slauson

One of the biggest challenges in developing a trading systems is being precise when

defining the rules. Technical analysis is often criticized because many of its

adherents are so ambiguous with their methodology. So ambiguous in fact that it

becomes impossible to validate their “system” using any semblance of scientific

methods. This is convenient for the trading system peddler, but frustrating for

the trader. Among technicians, the well worn adage “the trend is your friend” is

sadly second only to “technical analysis is an art not a science.” The latter is

a eupSome

examples of ambiguous trading rules I often hear:hemism for: “I have

a system that works super awesome...except when it doesn’t.”

Some examples of ambiguous trading rules I often hear:

- Prices should move slightly

above….

- Volatility can increase a bit….

- Place the stop just above a recent

high…

- Prices should cross above the moving average on big volume...

- Prices will reverse at about the same price level

several times…

- The trend must be steeply up over the short-term…

- The black candlestick must be significantly larger than

the preceding white candlestick…

To move technical analysis out of the realm of art and into the realm of science,

ambiguous words like the ones in bolded italics must be eliminated and replaced

with precise, quantifiable values.

Of all the tools used by technicians, support and resistance is perhaps the most

difficult to quantify. Ask 10 traders to draw support and resistance lines on the

same chart and you’ll see lines drawn at almost every price level Years ago I

developed a scoring method to help traders quantify support and resistance levels.

I presented this method at a conference sponsored by Golden Gate University. In

attendance was W.H.C. Bassetti, editor and coauthor of the classic book, Technical

Analysis of Stock Trends first written by Robert D. Edwards and John Magee in 1948.

Bassetti referenced my scoring method and the MetaStock Add-on based on it (PowerStrike),

in the 9th edition of his book.

The methodology I presented for measuring support and resistance is based on three

phenomenon in the stock market:

- Humans prefer “easily” divisible and memorable numbers (e.g.,

“20” is preferred over “19”). These values are typical of option

strike prices. Hence many traders' attention is drawn to these

numbers providing the potential for even more "concentrated"

buying and selling.

- Stock prices are heavily influenced by trading near option strike

price levels. Hence, these levels greatly influence where

"important" buying and selling occur. Support and resistance is

based on the concentrated buying and selling. Option Strike

Price levels attract more attention from important market

participants over other price levels.

- Bullish and Bearish pressures at Option Strike Price levels

resolve more quickly than pressures at other levels.

With these general principles in mind, I developed a tool that scored the strength

of support and resistance on optionable US stocks. The heart of the scoring method

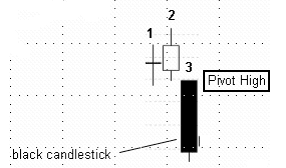

revolves around three bar pivot highs and three bar pivot lows. A value of 1, 3

o 5 points is assigned to a pivot high or low based on the volume associated with

bars 1 and 3 of the pattern.

To be counted in the score a pivot highs or lows has to form within a specified distance

(based on precise volatility bands) from an option strike price. Totaling these

values provides a specific score for the support or resistance level being measured.

The score can then easily be used independently or incorporated into a larger set

of trading rules. It can even be backtested, an important litmus test for a valid

trading method.

The following chart of Costco illustrates this scoring system. Pivots highs that

occurred near the 120 strike price totaled 14. Pivot lows near the 110 strike price

totaled 30. “Near” is precisely defined as pivot highs and lows that form within

the volatility bands drawn at each level. From this we can objectively state that

support at

$110 is stronger than resistance at $120.

My point in presenting this scoring method is not to sell you on this specific method

of identifying support and resistance; it is simply to illustrate that it is possible

to take the ambiguity and “art” out of technical analysis, even something as subjective

and seemingly imprecise as support and resistance. Do this and you may avoid becoming

a “starving artist.”

Back to top

|

|

|

|

|

|

| Users browsing this topic |

|

Guest (Hidden)

|

Forum Jump

You cannot post new topics in this forum.

You cannot reply to topics in this forum.

You cannot delete your posts in this forum.

You cannot edit your posts in this forum.

You cannot create polls in this forum.

You cannot vote in polls in this forum.