The word cattle can conjure images of wild prairies and rugged western landscapes, cattle drives, wealthy barons, and cowboys. The beef and cattle industry today is a multi-billion dollar industry, and cattle futures on the CME are not only a means for industry professionals to access hedging opportunities, but also an avenue for speculators to participate in cattle trade - with or without the ten gallon hat.

Contract Size: 40,000 lbs

Price Quote & Tick Size: cents per pound; minimum fluctuation is $.00025 per pound ($10 per contract)

Contract Months: February, April, June, August, October, December

Trading Specs: Floor trading is conducted 9:05 am to 1:00 pm CT Mon - Fri; Globex trading Mon 9:05 a.m. - Fri 1:55 p.m. CT. Daily trading halts from 4:00 p.m.-5:00 p.m.

Daily Price Limit: $.03 per pound above or below previous day's settlement price

Trading Symbols: LC; LE on Globex

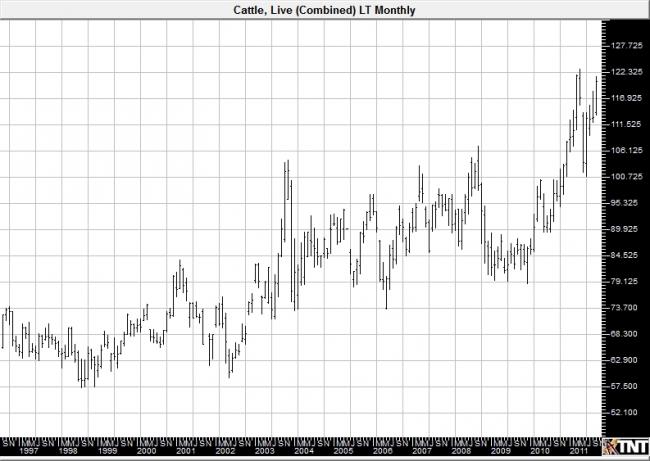

Past performance is not indicative of future results.

***chart courtesy of Gecko Software

Live Cattle FactsCattle have a rich and diverse global history and were among the first domesticated animals, providing a rich source of food as well as animal power for laboring in fields and transport. The word cattle originally meant "possession", hence the similarity to chattel - but now refers to bovines. Breed registrations across the globe now refer to over 900 different breeds of cattle with some able to trace their bloodlines back for six centuries.

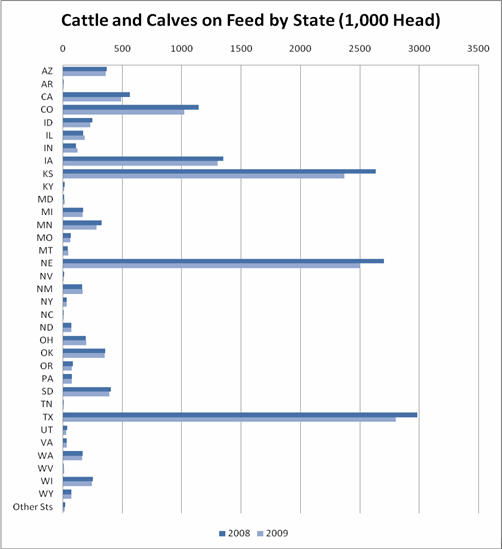

Within the United States, the cattle industry has had significant impact on the history and landscape of several states. Distribution of cattle on feed in the United States is illustrated as follows:

***Data courtesy USDA

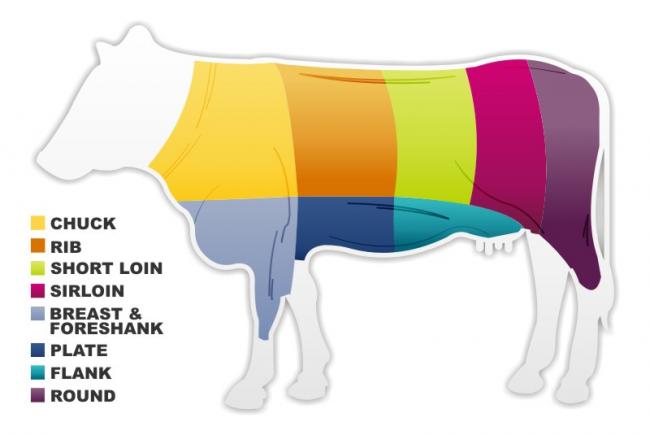

Live cattle come from feedlots where they have been fed a diet of grains and hay - usually in an average ratio of over eight pounds of feed per one pound of weight gain. When they weigh at or above 1,000 pounds they are sold to packing houses. This general weight range usually results in a 600-pound carcass that can produce just over 400 pounds of meat. These numbers can change based on a few factors, but this helps illustrate a general idea of weights and meat production.

Cuts of beef are as illustrated below:

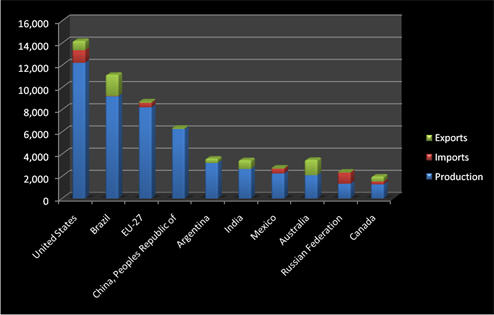

Internationally, noteworthy producers, exporters, and importers in 2008 were as illustrated. For reference, the quantities are for 1000 metric tons, carcass weight equivalents:

***Data courtesy USDA

Price highlights for this market include:* News articles from the 1940s suggest that confusion reigned in the cattle markets amid price controls, regulations, and subsidies until President Truman scrapped these things in 1946. The removal of perceived ceilings led to a jump in cattle prices, to about $27 per hundred pounds for some choice.

* In the 1970s prices were frequently between the $40 and $50per hundred pounds level, but prices spiked in 1973 and 1975 on "cutbacks." Prices jumped above $60 in 1978 in response to a "low point in the cattle cycle" where producers had cut back on their herd sizes in response to lower prices. (Source: Youngstown Vindicator - May 16, 197

* In 1979, prices continued to soar, eventually topping $80 per hundred pounds on forecasts that a beef shortage would continue. Prices retreated from this level, but stayed mostly between $60 and $70 per hundred pounds until the mid-1980s.

* In 1985 greater supplies were cited as the cause for a precipitous price drop back towards the low $50 per hundred pounds.

* Prices were down again in 1996, prompting then-President Clinton to try to take steps including a $50-million beef purchase and opening up of federal lands for grazing in an effort to boost prices. Some analysts claimed that mention of Mad Cow disease on an e[censored]ode of The Oprah Winfrey Show sparked the price declines.

* Late 2000 - early 2001 brought another spike in live cattle prices, driven by stronger demand which saw prices move above $80 per hundred pounds.

* Discovery of Bovine Spongiform Encephal-opathy (mad cow disease) in Washington in 2003 wreaked havoc on prices, with a range between approximately $75 to $104 per hundred pounds as volatility entered the market. Mad cow concerns cut into beef demand forecasts through the 2000s.

* In 2011, prices went through the $120 level as higher feed costs and other factors brought herd levels to historic lows.

Key terms for this market include:Choice beef - the high quality beef, just below prime in the grading system. A little over 50 percent of US carcasses qualify as choice grade. They have less fat and marbling than prime.

CWE - the abbreviation for Carcass-weight Equivalent, the weight meat products "converted to an equivalent weight of a dressed carcass" according to the USDA. This includes inedible bits like bone and ligaments.

Foot-and-mouth or hoof-and-mouth disease - A viral disease that is extremely contagious and can be fatal. It affects many cloven-hoofed animals. An identified breakout can often lead to quarantine and culling of herds.

Key UsesBeef cattle brings us steak, ground beef for hamburgers, roast beef, and a variety of other meat cuts which provide the majority of zinc in the average American diet. Beyond the obvious food products that come from cattle, medicines like insulin and estrogen come from their glands. Cowhide and leather, glue, and fertilizers are all byproducts of the beef industry. Tallow - also known as beef fat - is also an ingredient in various household and hygiene products like soap, candles, and cosmetics. Bones and horns are a source of gelatin used in marshmallows, candies, and other confections.

Key ConcernsIn addition to the following variables, if you are trading live cattle, you will also want to be aware that the USDA issues reports that may impact the futures market including Cattle on Feed and Livestock Slaughter . These reports (and others) may be found in the economics and statistics sections of the USDA website.

Import and Export: Restrictions and trade agreements can often impact the quantity of imports and exports to and from various countries.

Health Issues: Concerns over red meat consumption and possible links to colon cancer or saturated fat values are often weighed against beef as a rich source of linoleic acid and B vitamins. As health news comes and goes, domestic consumption or demand may be impacted.

Mad Cow Disease: Otherwise known as bovine spongiform encephalopathy, Mad Cow scares can wreak havoc on the cattle industry and breakouts can lead to massive slaughter and burn campaigns. Since the BSE prion cannot be destroyed by cooking, the panic of spread can easily affect both demand and supply of cattle.

Feed Costs: Higher feed costs can typically affect the weight and rate at which a farmer will take livestock to market. Since cattle are fed a combination of roughage, grain and protein supplements (soybean meal is a popular protein source), prices for corn, alfalfa, soybean, and even wheat can impact choice of feed and affect the feed-to-meat conversion - as well as the number of days on the feedlot.

Disclaimer: There is a substantial risk of loss in

futures trading and it is not suitable for all investors. Losses can exceed your account size and/or margin requirements. Commodities trading can be extremely risky and is not for everyone. Some trading strategies have unlimited risk. Educate yourself on the risks and rewards of such investing prior to trading. Futures Press Inc., the publisher, and/or its affiliates, staff or anyone associated with Futures Press, Inc. does not guarantee profits or pre-determined loss points, and are not held monetarily responsible for the trading losses of others (subscribers or otherwise). Past results are by no means indicative of potential future returns. Fundamental factors, seasonal and weather trends, and current events may have already been factored into the markets. Information provided is compiled by sources believed to be reliable. Futures Press, Inc., and/or its principals, assume no responsibility for any errors or omissions as the information may not be complete or events may have been canceled or rescheduled. Any copy, reprint, broadcast or distribution of this report of any kind is prohibited without the expressed written consent of Futures Press, Inc.