Often considered the life-blood of developed nations, RBOB is one of the headline-making products from the energy sector of NYMEX. Short for “reformulated gasoline blendstock for oxygen blending”, this crude oil derivative is an integral part of daily life and the subject of frequent debate and news discussions.

Contract Size: 42,000 gallons (about 1,000 barrels)

Price Quote & Tick Size: U.S. Dollars and cents per gallon; minimum tick size .01 cents per gallon or $4.20 per contract.

Contract Months: All months

Trading Specs: Open outcry trading is conducted from 9:00 AM until 2:30 PM ET. Electronic trading via the CME Globex® trading platform Sunday – Friday 6:00 p.m. – 5:15 p.m. (5:00 p.m. – 4:15 p.m. Chicago Time/CT) with a 45-minute break each day beginning at 5:15 p.m. (4:15 p.m. CT) Clearport trading Sunday – Friday 6:00 p.m. – 5:15 p.m. (5:00 p.m. – 4:15 p.m. Chicago Time/CT) with a 45-minute break each day beginning at 5:15 p.m. (4:15 p.m. CT)

Daily Price Limit: $0.25 per gallon ($10,500 per contract) for all months. If any contract is traded, bid, or offered at the limit for five minutes, trading is halted for five minutes. When trading resumes, the limit is expanded by $0.25 per gallon in either direction. If another halt were triggered, the market would continue to be expanded by $0.25 per gallon in either direction after each successive five-minute trading halt. There will be no maximum price fluctuation limits during any one trading session.

Trading Symbols: RB

Past performance is not indicative of future results.

***chart courtesy of Gecko Software

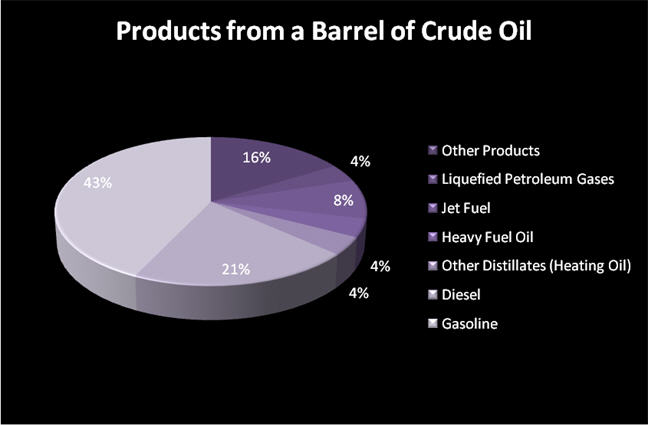

RBOB FactsGasoline is one of the many products that come from crude oil and normally accounts for the bulk of refinery products. From a typical barrel of oil, processing can yield the following:

***data courtesy of EIA

Gasoline quality and constituents can vary based on the type of crude oil it is derived from and the refining process used to produce it. It must also meet particular standards and environmental regulations which can vary from state to state and country to country. RBOB in particular is oxygenated via oxygen bearing compounds which are intended to reduce carbon monoxide emissions as well as smog and air pollutants. Ethanol is one of these added compounds, and in the United States corn ethanol is normally used.

Since specific areas have different requirements, gasoline produced distinctly for some areas cannot be used or substituted in others. Gasoline is normally held in bulk storage terminals after shipment through the pipeline and many additive packages are blended in the truck tank.

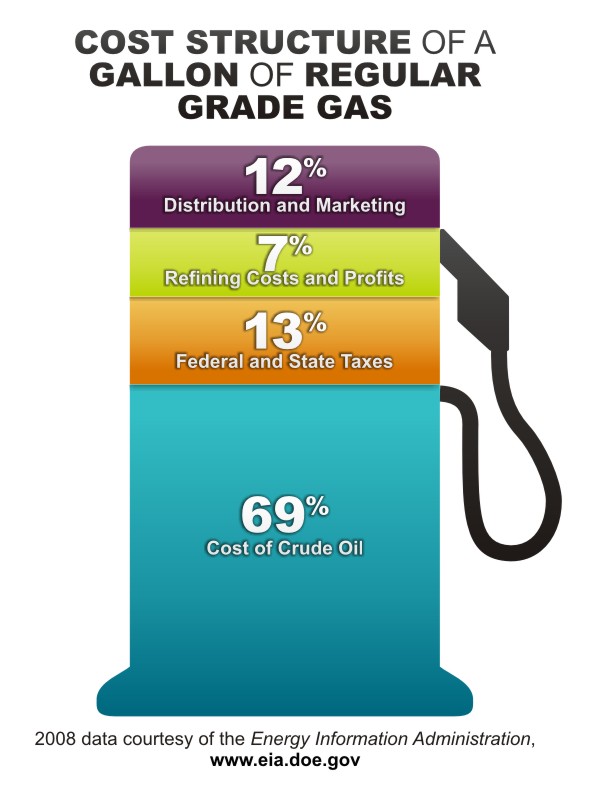

According to the EIA, the main components of the retail price of gasoline include the price of the crude oil, Federal and States’ taxes, refining costs and profits, and distribution and marketing costs. The percentage weight of these components in the overall price of gasoline can and has varied at different times and in different regions of the country. This is illustrated in the following:

Price highlights for this market include:

* In 1986 gas prices sagged below 50 cents as a perceived oil “glut” led prices lower. Prices would continue to chop on either side of 50 cents until the end of the decade.

* August of 1990 brought a swift spike in prices as Iraq invaded Kuwait. A high would be set above $1 a gallon before prices retreated towards year-end.

* In 1998 through early 1999, gas prices headed below the 50 cent level again as OPEC pumps worked to supply the oil market and supplies of fuel in the US stayed high. In March of 1999, an OPEC production cut helped prices rebound.

* The terrorist attacks and subsequent US response boosted prices above $1 through 2000-2001 but they would revisit 50 cents before the end of that year.

* In 2002, continuing Middle East turmoil and concerns over Venezuela’s oil supply would continue to boost gas prices.

* Early 2005 saw gas prices move above $1.50 a gallon as EIA reports showed a drop in supplies. In August, prices would soar above $2.50 a gallon in the wake of Hurricane Katrina.

* Volatility continued through the decade with prices going down to the $1.50 level at the end of 2005 and 2006, spiking towards $2.50 a gallon in early 2006 and 2007, and then jumping to a fresh high above $3.60 in 2008. After hitting the fresh high on a mix of global fundamentals – including a weak US dollar – prices would sag on demand concerns, dropping back below $1 a gallon at the end of 2008.

* Prices turned higher in 2009 on hopes of economic recovery in the US, and traded above $3.50 per gallon in early 2011 on renewed concerns over unrest in the Middle East.

Key terms for this market include:

Crack Spread – a term for the price difference between oil and its components. The refinery “cracks” crude into other petroleum products. A crack spread in the futures market can involve the simultaneous purchase and sale of oil and derivatives contracts.

New York Harbor – home to a delivery place for petroleum products from refineries. Terminals here are the major trading center for the East Coast of the United States.

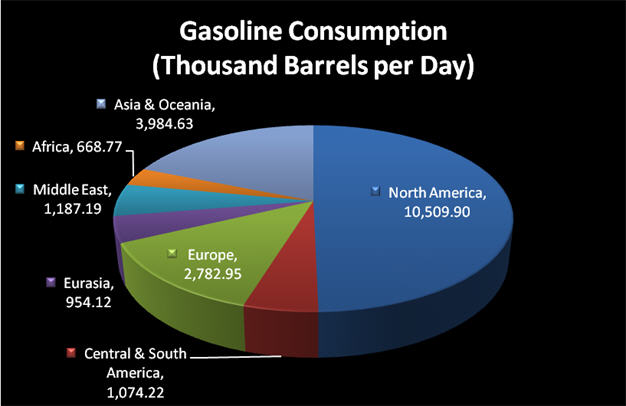

Key Uses The obvious end use for RBOB is as a motor fuel. Developed Western nations account for the bulk of gasoline consumption and regional daily consumption in 2005 was as follows:

***data courtesy of EIA

Key Concerns As with crude oil, weekly statistics released by the EIA and API can bring a fair amount of price volatility to RBOB markets. In addition to the weekly reports, the following items can also bring price fluctuations and are events and information worth noting:

Supply and Demand – The level of gasoline supply relative to overall demand can fluctuate and affect prices. Possible seasonal demand and competition on a retail level can also exert pressure on supplies and affect price even if crude oil prices are stable. Any event which threatens the supply or refining output such as weather disruptions, refinery maintenance, or pipeline issues may affect prices.

Crude Oil Supply and Demand – Since gasoline prices have anywhere from 40 to 60 percent of their value derived from crude oil prices, any changes in crude oil supply and price may have a direct impact on the cost of gasoline.

Refining and Imports – These numbers give an indication of the stocks of gasoline and relative to the overall consumption, changes in crude oil supply and refining and imports of refined gasoline are of great interest.

Environmental Issues – Just as environmental protection programs have changed the constituents of gasoline, they may also impact price. On a retail level, California’s fuel regulations are normally cited as a cause of their higher pump prices. Changes in legislation or requirements for additional ethanol blending as well as the source of ethanol additives are all worthy of attention.

Disclaimer: There is a substantial risk of loss in

futures trading and it is not suitable for all investors. Losses can exceed your account size and/or margin requirements. Commodities trading can be extremely risky and is not for everyone. Some trading strategies have unlimited risk. Educate yourself on the risks and rewards of such investing prior to trading. Futures Press Inc., the publisher, and/or its affiliates, staff or anyone associated with Futures Press, Inc. does not guarantee profits or pre-determined loss points, and are not held monetarily responsible for the trading losses of others (subscribers or otherwise). Past results are by no means indicative of potential future returns. Fundamental factors, seasonal and weather trends, and current events may have already been factored into the markets. Information provided is compiled by sources believed to be reliable. Futures Press, Inc., and/or its principals, assume no responsibility for any errors or omissions as the information may not be complete or events may have been canceled or rescheduled. Any copy, reprint, broadcast or distribution of this report of any kind is prohibited without the expressed written consent of Futures Press, Inc.